Taxation of Music Promoters & Musicians

According to section 8 of the Income Tax Act (1995) every person is charged tax on a taxable income for each tax year. The income must be sourced in Botswana or deemed to be sourced in Botswana. The word person in this context includes businesses.

Musicians and Music Promoters derive their income from a business of promoting music or singing (entertainment). Therefore taxation of Musicians and Music Promoters falls under taxation of business income. Business income is generally taxed at the rate of 25% if the business is a company. In case of an individual business the rate is progressive ranging from 0% to 25% depending on your income.

In case of non-resident musicians who normally come to perform in Botswana for a short period of time, the law provides for a withholding of tax on their income. In this case the promoter or any person responsible for bringing the foreign entertainer into Botswana must deducts tax at the rate of 10% before paying the non- resident Musician and remit the amount to BURS.

The liability to pay income tax is upon a person therefore any person who earns income or derives income from a business must register with BURS to declare such income, including Promoters and Musicians.

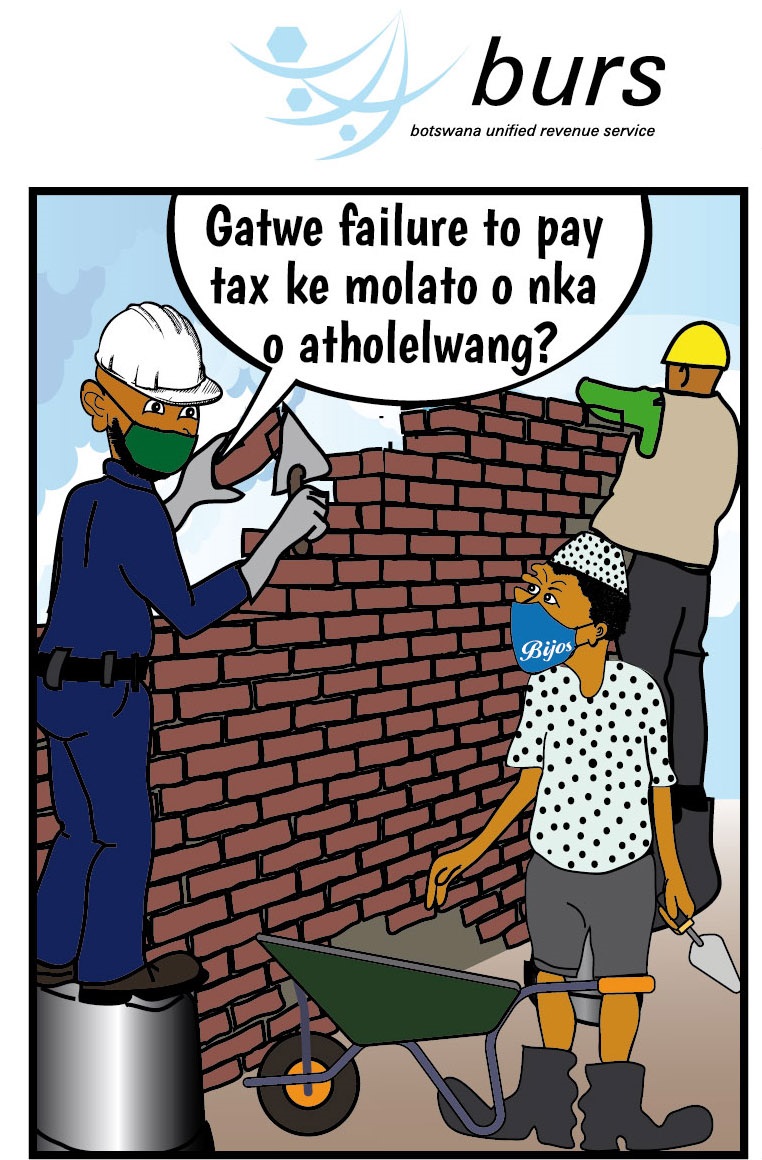

Regarding compliance, BURS has realized that not all Music Promoters and Musicians are complying with the revenue laws. Therefore in addition to public education and awareness provided, BURS is currently organizing specific workshops to educate Music Promoters and Musicians on their Tax obligations and rights.